Meet our licensed agent Davina Kornegay!

Davina Kornegay, licensed insurance Broker with Barefoot Insurance Brokers is working with over 18 unique auto insurance carriers at present to bring you the most competitive pricing for the following Florida insurance products:

- Automobile Insurance

- Motorcycle Insurance

- Antique/ Classic Auto

- Commercial Auto

- Heavy Truck Insurance

- Boat, RV, and ATV Insurance

- Renter’s Insurance

- Condo Insurance

- Homeowner’s Insurance

- SR-22

- FR-44

- Owner’s & Non-owner’s policies

- Contractor’s General Liability

- Commercial Lines (Retail, Storefronts, Auto Repair Shops, Offices, etc.)

- Life Insurance & Annuities

- Personal Umbrellas

- AFLAC

- & More!

Most consumers are currently paying more than they’d like for their Florida insurance Products and I’m interested in helping you find a better value for your Florida insurance needs. I can also work with clients who don’t presently have Florida car insurance but are in immediate need for coverage—I can quote and bind auto insurance on the same day!

The market for insurance is always changing in Florida. Obtaining free quotes is a simple step in finding out whether there is money to be saved or at least become more knowledgeable about that type of insurance you’re purchasing for yourself.

For auto insurance, it might be useful to know how you plan on using your vehicle such as pleasure, commuting, or business use on the Florida Roadways. Especially with heavy trucks, which can carry an assortment of goods or services, it is always best to know exactly what it will be used for, your mileage radius from your home or business headquarters, and how often you’ll be visiting jobsites or new clients. This can be particularly important because it gives me, your insurance agent, a better idea of what carriers will underwrite your particular risk and offer you affordable coverage.

Davina’s main coverage territories span all over Brevard County including Palm Bay, Melbourne, Titusville, Mims and the coastal areas including Merritt Island, Cocoa Beach and Indian Rocks Beach. Davina Kornegay is a licensed Property & Casualty Insurance Broker in Florida.

Davina Kornegay will strive to offer you the most competitively priced insurance options for your needs across the State of Florida. Call 321-218-3880 or text (321)222-7965 or email me at davina@barefootins.com today to complete a NO OBLIGATION analysis of your current insurance policies and FREE QUOTES to save you some money on your Florida insurance coverages.

#bestcarinsurance #affordableinsurance #commercialauto #heavytrucks #cargoinsurance #liabilitycoverage #onemillioncoverage #financialprotection #freequotes #refrigeratedtrucks #RVinsurance #ATVinsurance #classiccar #Rentersinsurance #HomeownersInsurance #CondoInsurance #Lifeinsurance #financialstrength #aflac #aflacagent #davinainsurance #davinakornegay

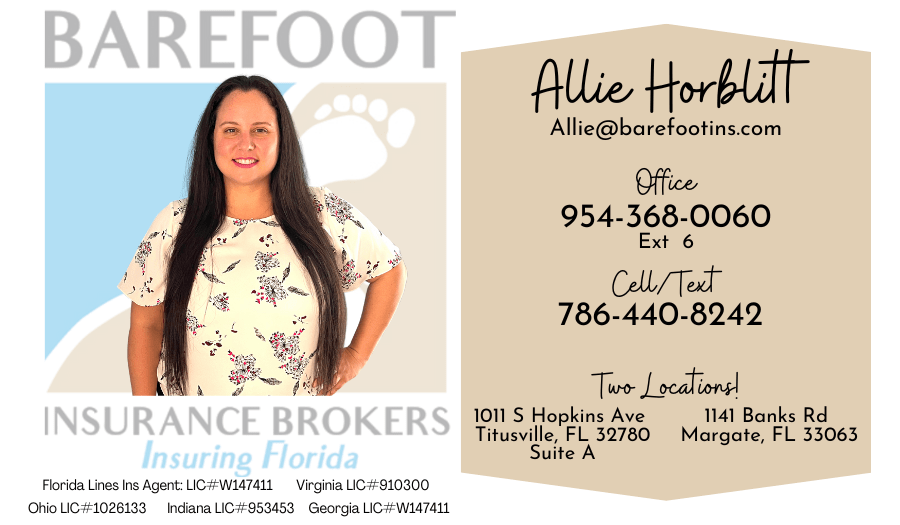

My name is Roxanne Martinez and I specialize in Commercial Auto Insurance coverage. I can be reached Monday – Friday from 10 am until 5 pm by calling 954-368-0060, x 9 or by email at

My name is Roxanne Martinez and I specialize in Commercial Auto Insurance coverage. I can be reached Monday – Friday from 10 am until 5 pm by calling 954-368-0060, x 9 or by email at

Recent Comments