The average single-family homeowner in Florida carries an HO-3 form of homeowner’s insurance that covers an array of different loss scenarios and coverages at various limits to cover both repairs and rebuilds your home and replace your personal property in the event of a loss. Most legitimate Florida Homeowner’s insurance claims submitted are due to internal water damage within the home–most carriers are now offering a sublimit or option to exclude this coverage now due to the risk— but other covered events under this policy form include:

- Theft

- Fire Damage

- Windstorm events like rain, tornadoes and fallen trees

- Airplane crash incidents

If you are financing your home, most mortgage lenders require a HO-3 homeowners’ insurance policy as part of the terms of lending.

Unlike your car insurance policy that might renew every 6 months, homeowner’s insurance terms typically renew on an annual basis every 12 months.

When applying for homeowner’s insurance quotes with an independent insurance agent, there are some insurance inspections you’ll want to consider obtaining prior to the quoting process. These include:

- Wind Mitigation Inspection– This is a visual examination of the condition of your roof and how it was constructed as well as other mitigating features that offer “discounts” on your Florida homeowner’s insurance premiums.

- 4 point inspection- Typically required on homes over 40 years or with updates from original, The “4 points” being inspected are: The roof, plumbing, HVAC system, and Electrical systems within the home and it surveys their condition and age for the insurer to assess whether they’re interested in providing coverage on any particular property. While these inspections can remain valid with the same insurer for your renewals for quite a while, the new Florida criteria is that this inspection is typically considered valid for 1 year on new business.

Every HO-3 Homeowner’s insurance policy in Florida is comprised of more than one coverage. Section I includes coverage for the building, secondary structures (if included) or insured property, Section II has details on Liability Coverages extended to the insured property and the last section is can include additional coverages both optional and included like a Loss of use feature or Ordinance and Law Increase or a higher mold coverage sublimit, depending on the options and value added benefits of the insurer.

Let’s break these coverages down a bit more:

Section one of the policy is designed to insure the value of your Dwelling (helps pay to repair or rebuild the physical structure if damaged by a covered hazard), Other Structures (protects structures on your property that are not connected to your home), Personal Property (helps cover the cost of your personal items if destroyed, damaged, or stolen due to a covered loss), and Loss of Use (can help pay for reasonable housing and living expenses in the event your home is temporarily unlivable while being repaired).

Section II will typically outline the Property Liability Insurance Coverage (when someone claims you or your negligence caused the injury or property damage) and medical payments (to others, not residents) in the event that there is an accident on your property.

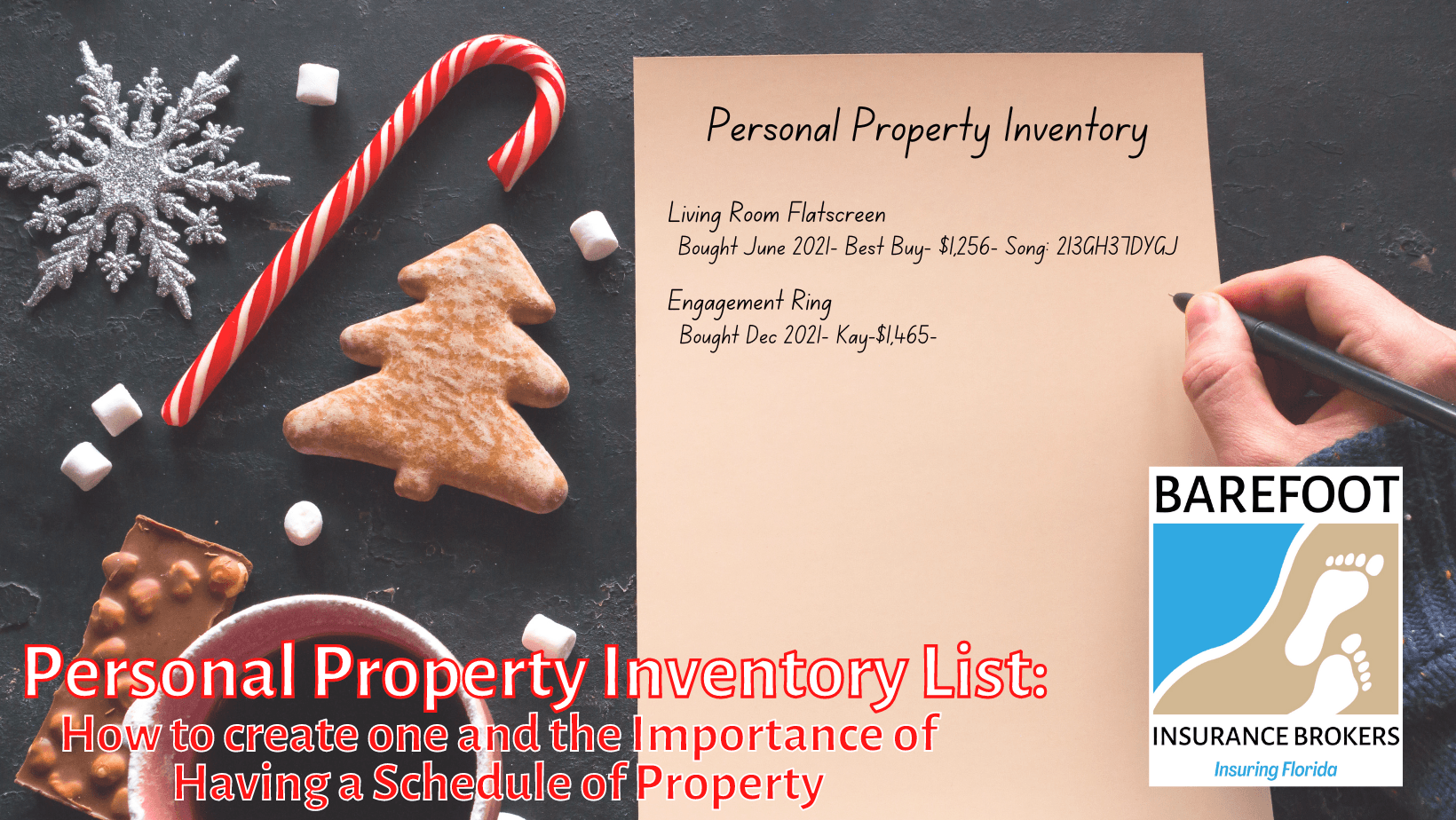

Sub-limits primarily impact certain kinds of personal property coverage or specific losses covered under your Florida homeowner’s insurance policy. A sublimit is the most money a carrier will reimburse you for a covered loss, sometimes subject to the deductible but always subject to the terms of the individual policy contract. Some typical examples of sublimits include:

- Computers: $1500

- Fine Art: $2500

- Firearms: $2000

- Jewelry: $1000 to $5000

Now that we have a better understanding of some of our Florida Homeowner’s insurance policy elements, lets discuss what’s going on in news about our current coverage and the future of our insurance coverage in Florida!

Florida is in the midst of a homeowner’s insurance crisis. Our current state Statutes so haphazardly dictate the business practices of insurance carriers creating an increase in cost, a decrease in product availability and the likelihood of our State-Backed Residual insurer, Citizens Property Insurance Corporation, increasing prices to reduce demand for their product. In the coming week there will be a special session in regards to homeowners insurance amongst the State of Florida Lawmakers. As of Thursday morning there were no specific bills that had been filed just yet.

Previously Citizens Property Insurance Corporation (CPIC) has been a hot topic. CPIC was designed to be the insurer of last resort within the State of Florida and they were rarely synonymous for offering the lowest premiums in the marketplace.

Some officials are stating that if Citizens Property Insurance Corporation was to raise their premiums it would level out the market and create more flow to private insurers.

Private companies in today’s Florida Property Insurance market are an average of 44% higher in price than CPIC at this moment in time. Many Florida Homeowner’s insurance companies won’t even offer coverage on coastal homes in densely populated areas of Miami, Miami Beach, Sunny Isles Beach, Hollywood, Fort Lauderdale and Coastal Palm Beach County. Our Coastal Florida residents often have no options outside of CPIC for coverage and the increase in their costs of over 44% could further damage the state of the Market if not repealed by the Citizens of Florida this will affect.

The special session convenes Monday, December 12th, 2022. To make your voice heard we have listed numbers to call and emails to message as published by FAIA, Florida Association of Independent Agents:

Governor Ron DeSantis

(850) 717-9337 or GovernorRon.Desantis@eog.myflorida.com

Speaker of the House Paul Renner

(850) 717-5019 or Paul.Renner@myfloridahouse.gov

President of the Florida Senate Kathleen Passidomo

(239) 417-6205 or passidomo.kathleen.web@flsenate.gov

Please review the FAIA points of contention for the special session, attached.

Barefoot Insurance Brokers are dedicated to helping our fellow Floridians insure your Coastal Florida Property and securing coverage as efficiently and cost effectively as possible. If you feel that your private market premiums or your CPIC premiums are out of hand and you’re looking for ways to insurer within budget, please feel free to reach out to one of our licensed, Florida Insurance agents for Homeowner’s insurance quotes all over Florida and in high-risk places in Fort Lauderdale, Pompano Beach, Deerfield Beach, Lauderdale-by-the-Sea and Hallendale, Florida.

Barefoot Insurance Brokers offer an array of other products that would protect the average Florida Coastal Homeowner, too, including Flood Insurance, Inland Marine and Personal Article Floaters, Comprehensive auto insurance policies and Hurricane Protection Plans. Call today at 954-368-0060

Recent Comments