Personal Property Inventory List: “The Importance and how to create a Schedule of Property”

Personal Property Inventory List: “The Importance and how to create a Schedule of Property”

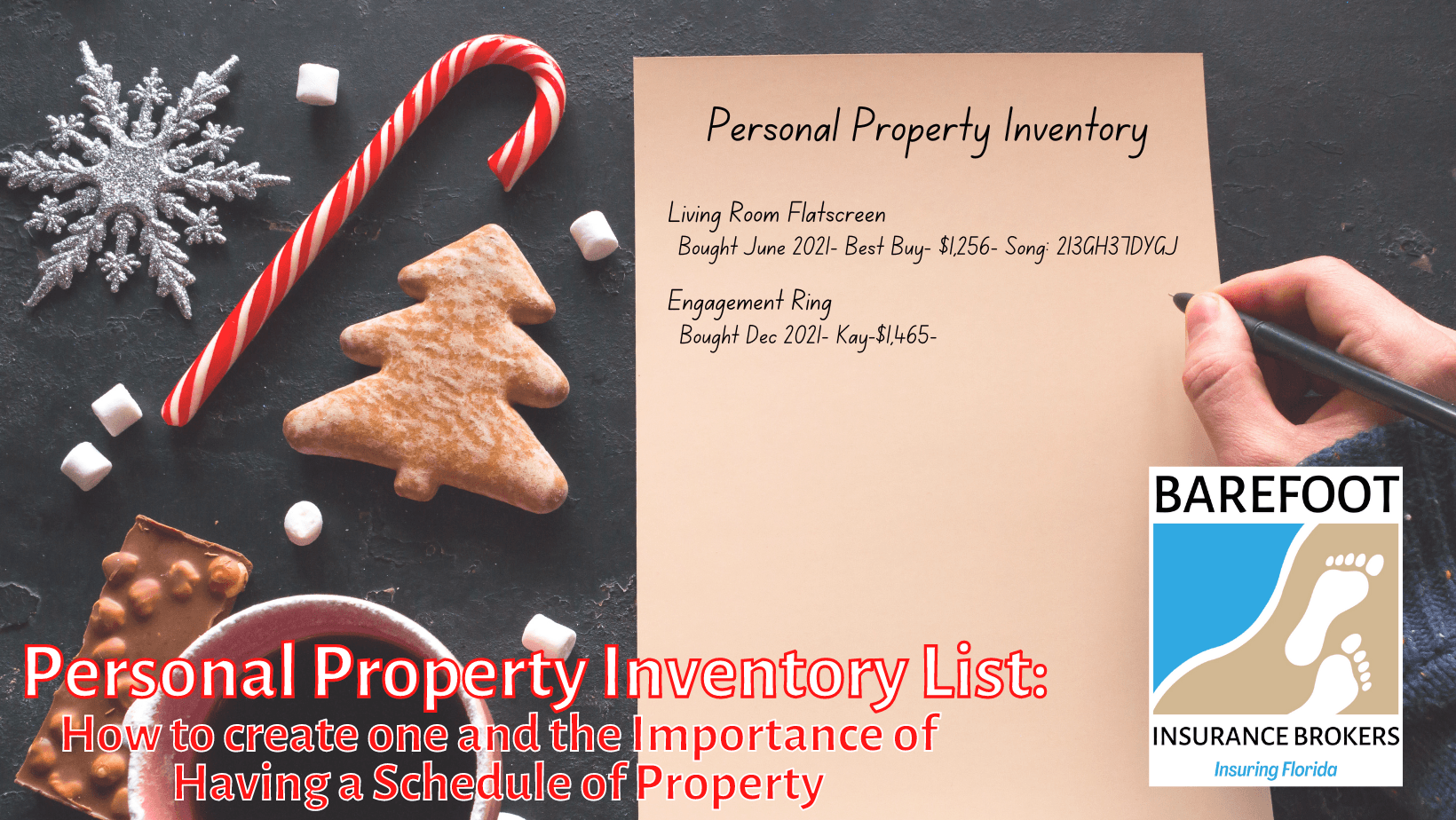

Do you remember the serial number on the back of your TV? How about where and for how much money you bought your gaming computer? What about the details surrounding that magical day you asked your girlfriend to be your wife? What was the value of her engagement ring? The clarity of the diamond? Where it was purchased?

Even cherished memories of our purchases may fade. Without receipts or appraisals or perhaps even a list of your personal property, how do you track the details for your Florida Homeowner’s or Renter’s Insurance provider in the event of a loss?

But what happens if those beloved items are lost or damaged? When submitting a claim for personal property an insurance company can provide apps to curate a list at the time of your insurance loss, or you could go about it in your own way, pen and paper or an Excel doc as another option. There are many tools online to help you create a detailed list of personal or business property so that you aren’t left with nothing at the time of an insurance claim.

Once you’ve chosen how to log the information and create a schedule of your belongings, whether it is digitally or handwritten, you’ll want to organize it for functionality in the event of an insurance loss. From there you can further organize it into items by room, perhaps. An easy way to make sure everything is categorized in a familiar way is to determine how you’re organizing your personal property on the schedule. You can organize by value, or by type (electronics, jewelry, furniture, etc).

As you go from room to room, the details of the valuable items you will put on your list should be:

– What the item is, with its make, model, serial number and purchase price.

– Where you bought the item and what it cost. (Include receipt of copy of receipt)

– Warranty Information

– Photos of the item

What you choose to put on this list is up to you, you can be as detailed as listing everything, tables, chairs, curtains, TVs, picture frames, just list the high ticket items (Electronics, Jewelry, Art), items that are meaningful (Heirlooms) or a mixture of all the above.

If you created a digital list, print outs should exist to further back them up and they should be stored off-site, in a safety deposit box or perhaps a work filing cabinet or safe.

How about a video inventory of your belongings? That’s a very efficient way to log your personal property for your insurance company if you ever were to sustain a loss by theft or fire.

Doing walk throughs, getting close up of serial numbers and such is a great addition to your list! And of course, never forget photos of the items as well. Serial numbers and general photos to show the quality and condition of each item so that they are properly accounted for.

Once you’ve made your list you should make a copy of it, both physically and digitally, one should be store at home and then one off property in the event of a total loss: safety deposit box or a loved one’s house. It’s advised to go over and update personal property list every 6 months or, in Florida, at the onset of hurricane season on June 1st or immediately after the holidays when you’ve done some purging and purchased new belongings.

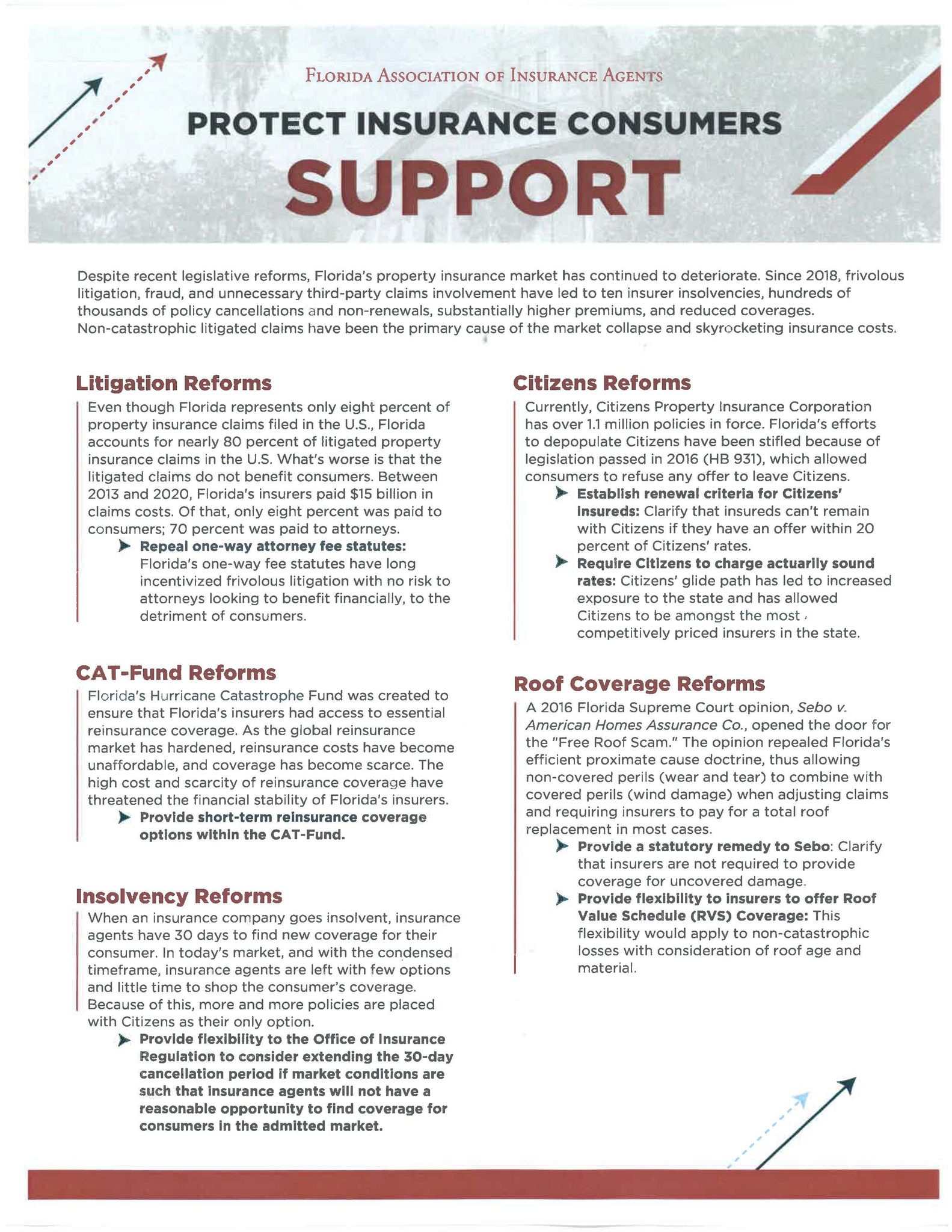

Navigating the waters of your property insurance in Florida can be a daunting task. While having a personal property inventory is one step of the process, it’s also helpful to have a trusted insurance advisor to discuss coverages, deductibles, sublimits and additional insurance products that can “fill your gaps” and make you whole in the event of an insurance loss.

Don’t hesitate to reach out to Barefoot Insurance Brokers of Titusville today for quotes and information to secure your Florida Home, your property inside and outside of your home and your Central Florida Business. Call us at 321-218-3880 or email allie@barefootins.com for more information today. Allie Horblitt is a licensed insurance agent in Florida with over 10 years of industry experience who would love to help you with your new Titusville, Mims, Cocoa, Viera, Melbourne and Cocoa Beach Homeowner’s Insurance.

My name is Roxanne Martinez and I specialize in Commercial Auto Insurance coverage. I can be reached Monday – Friday from 10 am until 5 pm by calling 954-368-0060, x 9 or by email at

My name is Roxanne Martinez and I specialize in Commercial Auto Insurance coverage. I can be reached Monday – Friday from 10 am until 5 pm by calling 954-368-0060, x 9 or by email at

Casey Carroll is a Florida Property & Casualty Insurance Broker with Barefoot Insurance Brokers located at 1011 S Hopkins Ave in Titusville, Florida. With a lifetime of experience on the water, Casey can help you insure your personal watercraft, yachts, and marine charters throughout the State of Florida. Casey can be contacted at casey@barefootins.com via email.

Casey Carroll is a Florida Property & Casualty Insurance Broker with Barefoot Insurance Brokers located at 1011 S Hopkins Ave in Titusville, Florida. With a lifetime of experience on the water, Casey can help you insure your personal watercraft, yachts, and marine charters throughout the State of Florida. Casey can be contacted at casey@barefootins.com via email.

Recent Comments