Cook with Caution

According to the U.S. Fire Administration, cooking is the leading cause of home fires.

To help prevent cooking fires, check out these tips

According to the U.S. Fire Administration, cooking is the leading cause of home fires.

To help prevent cooking fires, check out these tips

Julia Dourvetakis, licensed Property & Casualty Insurance Brokers, can assist you with your Commercial Insurance Package for your new, growing or profitizing Landscape business, specializing in Florida lawn carecompanies with 10-25 employees.

A licensed insurance broker with Barefoot Insurance Brokers of Florida can better help you understand what’s covered on your existing commercial insurance suite as well as help you find more affordable and efficient insurance products and solutions to scale and grow your business. We recommend that you reach out to Florida Commercial Insurance Specialist Julia Dourvetakis via call or text at 954-866-5723 this holiday season for helpful insurance insight, advice and quotes to protect and grow your landscaping and lawncare asset in 2025 and beyond.

Julia Dourvetakis can service your Commercial insurance needs across the State of Florida.

Navigating insurance can seem like navigating rough waters, but we’re here to make it smooth sailing for you! Did you know that packaging your Marine Operator Legal Liability (MOLL) insurance with a standard General Liability Insurance can be simple and affordable?

Introducing Julia Dourvetakis, your trusted Independent Insurance Agent with Barefoot Insurance Brokers! Julia specializes in assisting clients in Coastal Indian River county, including Vero Beach, Sebastian, Satellite Beach, Patrick Shores, Indialantic, Cape Canaveral, and throughout Merritt Island with all insurance needs, including coverages for Marine Contractors and Marine Artisan Contractors.

Let Julia guide you through the process and help you find the right coverage tailored to your needs. Protect your business with confidence! ![]()

![]()

Contact Julia today to learn more and secure your coverage! Julia is best reached via email julia@barefootins.com or by call/text to 954-866-5723

#MarineInsurance #MOLLIinsurance #GeneralLiability #BarefootInsuranceBrokers #CoastalInsurance #VeroBeach #Sebastian #SatelliteBeach #Indialantic #CapeCanavera l#MerrittIsland

A wax technician, like professionals in many service industries, could benefit from having professional liability insurance for several reasons:

1. Protection Against Claims: Professional liability insurance, often called errors and omissions (E&O) insurance, protects against claims of negligence or mistakes made by the technician. For a wax technician, this could include claims related to skin burns, allergic reactions, or improper waxing techniques.

2. Legal Costs: If a client files a lawsuit against the wax technician, the legal fees and court costs can be substantial. Professional liability insurance can help cover these expenses, saving the technician from potentially crippling financial burdens.

3. Peace of Mind: Knowing that they are covered by professional liability insurance can give wax technicians peace of mind. They can focus on providing quality services to their clients without constantly worrying about the possibility of a claim.

4. Business Reputation: In the event of a claim or lawsuit, having professional liability insurance can help protect the technician’s reputation. Clients may view insurance coverage as a sign of professionalism and responsibility, which can be beneficial for attracting and retaining clients.

5. Compliance with Requirements: In some jurisdictions or for certain certifications, professional liability insurance may be a requirement for practicing as a wax technician. Having the appropriate insurance coverage ensures compliance with legal and professional standards.

In summary, professional liability insurance is essential for wax technicians to protect themselves financially and legally from potential claims and lawsuits arising from the services they provide. It offers a safety net that can help them navigate challenges and maintain a successful business.

Contact Julia Dourvetakis today of Barefoot Insurance Brokers for more information on the suite of coverages available for your waxing salon. Julia can be reached by email at julia@barefootins.com or by phone 954-866-5723

#floridasalon #waxsalon #professionalliability #floridainsurance #juliadourvetakis

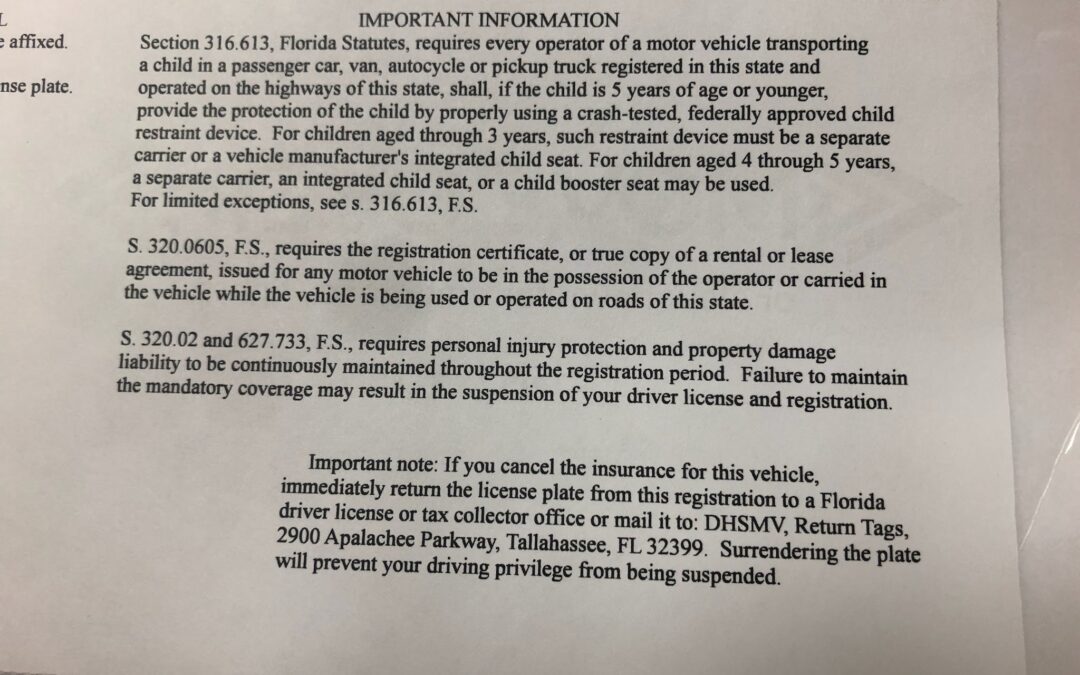

To surrender your license plate to the Florida Department of Highway Safety and Motor Vehicles (FLHSMV) when you move out of Florida, you can follow these general steps:

It’s always a good idea to check with the specific FLHSMV office you plan to visit or contact their customer service for any additional requirements or information specific to your situation. Keep in mind that the process may vary, and it’s essential to comply with Florida’s regulations regarding license plate surrender when moving out of the state. The Phone number for FLHSMV is 850-617-2000.

*Information was primarily obtained from flhsmv.gov

If you have specific insurance or car insurance related questions within the State of Florida or you’re looking for an indpendent auto insurance broker to provide you with auto insurance quotes when you’re new to Florida, please contact Allie Horblitt with Barefoot Insurance Brokers at 786-440-8242 or by email at allie@barefootins.com.